Peak oil is the theorized point in time when the maximum rate of extraction of petroleum is reached, after which it is expected to enter terminal decline. Peak oil theory is based on the observed rise, peak, fall, and depletion of aggregate production rate in oil fields over time. It is often confused with oil depletion; however, whereas depletion refers to a period of falling reserves and supply, peak oil refers to peak, before terminal depletion occurs. The concept of peak oil is often credited to geologist M. King Hubbert whose 1956 paper first presented a formal theory.

Some observers, such as petroleum industry experts Kenneth S. Deffeyes and Matthew Simmons, predicted there would be negative global economy effects after a post-peak production decline and subsequent oil price increase because of the continued dependence of most modern industrial transport, agricultural, and industrial systems on the low cost and high availability of oil. Predictions vary greatly as to what exactly these negative effects would be. While the notion that petroleum production must peak at some point is not controversial, the assertion that this must coincide with a serious economic decline, or even that the decline in production will necessarily be caused by an exhaustion of available reserves, is not universally accepted.

Oil production forecasts on which predictions of peak oil are based are sometimes made within a range which includes optimistic (higher production) and pessimistic (lower production) scenarios. A 2013 study concluded that peak oil “appears probable before 2030,” and that there was a “significant risk” that it would occur before 2020, and assumed that major investments in alternatives will occur before a crisis, without requiring major changes in the lifestyle of heavily oil-consuming nations. Pessimistic predictions of future oil production made after 2007 state either that the peak has already occurred, that oil production is on the cusp of the peak, or that it will occur soon.

Hubbert’s original prediction that US peak oil would occur in about 1970 appeared accurate for a time, as US average annual production peaked in 1970 at 9.6 million barrels per day and mostly declined for more than 3 decades after. However, the use of hydraulic fracturing caused US production to rebound during the 2000s, challenging the inevitability of post-peak decline for the US oil production. In addition, Hubbert’s original predictions for world peak oil production proved premature. Nevertheless, the rate of discovery of new petroleum deposits peaked worldwide during the 1960s and has never approached these levels since.

Modeling global oil production

The idea that the rate of oil production would peak and irreversibly decline is an old one. In 1919, David White, chief geologist of the United States Geological Survey, wrote of US petroleum: “… the peak of production will soon be passed, possibly within 3 years.” In 1953, Eugene Ayers, a researcher for Gulf Oil, projected that if US ultimate recoverable oil reserves were 100 billion barrels, then production in the US would peak no later than 1960. If ultimate recoverable were to be as high as 200 billion barrels, which he warned was wishful thinking, US peak production would come no later than 1970. Likewise for the world, he projected a peak somewhere between 1985 (one trillion barrels ultimate recoverable) and 2000 (two trillion barrels recoverable). Ayers made his projections without a mathematical model. He wrote: “But if the curve is made to look reasonable, it is quite possible to adapt mathematical expressions to it and to determine, in this way, the peak dates corresponding to various ultimate recoverable reserve numbers”

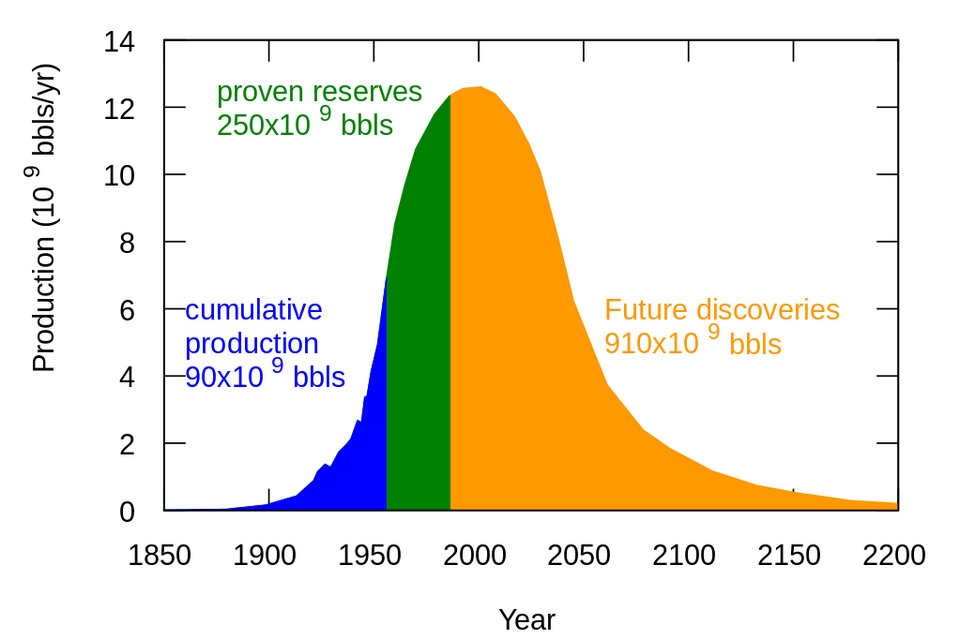

By observing past discoveries and production levels, and predicting future discovery trends, the geoscientist M. King Hubbert used statistical modelling in 1956 to predict that United States oil production would peak between 1965 and 1971. This prediction appeared accurate for a time however during 2018 daily production of oil in the United States was exceeding daily production in 1970, the year that was previously the peak. Hubbert used a semi-logistical curved model (sometimes incorrectly compared to a normal distribution). He assumed the production rate of a limited resource would follow a roughly symmetrical distribution. Depending on the limits of exploitability and market pressures, the rise or decline of resource production over time might be sharper or more stable, appear more linear or curved. That model and its variants are now called Hubbert peak theory; they have been used to describe and predict the peak and decline of production from regions, countries, and multinational areas. The same theory has also been applied to other limited-resource production.

More recently, the term “peak oil” was popularized by Colin Campbell and Kjell Aleklett in 2002 when they helped form the Association for the Study of Peak Oil and Gas (ASPO). In his publications, Hubbert used the term “peak production rate” and “peak in the rate of discoveries”.

The report noted that Hubbert had used the logistic curve because it was mathematically convenient, not because he firmly believed it to be correct. The study observed that in most cases, the asymmetric exponential model provided a better fit, and that peaks tended to occur well before half the oil had been produced, with the result that in nearly all cases, the post-peak decline was more gradual than the increase leading up to the peak.

Demand

The demand side of peak oil over time is concerned with the total quantity of oil that the global market would choose to consume at various possible market prices and how this entire listing of quantities at various prices would evolve over time. Global demand for crude oil grew an average of 1.76% per year from 1994 to 2006, with a high growth of 3.4% in 2003–2004. After reaching a high of 85.6 million barrels (13,610,000 m3) per day in 2007, world consumption decreased in both 2008 and 2009 by a total of 1.8%, despite fuel costs plummeting in 2008. In spite of this lull, world’s demanded for oil is projected to increase 21% over 2007 levels by 2030 (104 million barrels per day (16.5×106 m3/d) from 86 million barrels (13.7×106 m3)), or about 0.8% average annual growth, largely due to increases in demand from the transportation sector. According to projections by the International Energy Agency (IEA) in 2013, growth in global oil demand will be significantly outpaced by growth in production capacity over the next 5 years. Developments in late 2014–2015 have seen an oversupply of global markets leading to a significant drop in the price of oil.

Energy demand is distributed amongst four broad sectors: transportation, residential, commercial, and industrial. In terms of oil use, transportation is the largest sector and the one that has seen the largest growth in demand in recent decades. This growth has largely come from new demand for personal-use vehicles powered by internal combustion engines. This sector also has the highest consumption rates, accounting for approximately 71% of the oil used in the United States in 2013. and 55% of oil use worldwide as documented in the Hirsch report. Transportation is therefore of particular interest to those seeking to mitigate the effects of peak oil.

Although demand growth is highest in the developing world, the United States is the world’s largest consumer of petroleum. Between 1995 and 2005, US consumption grew from 17,700,000 barrels per day (2,810,000 m3/d) to 20,700,000 barrels per day (3,290,000 m3/d), a 3,000,000 barrels per day (480,000 m3/d) increase. China, by comparison, increased consumption from 3,400,000 barrels per day (540,000 m3/d) to 7,000,000 barrels per day (1,100,000 m3/d), an increase of 3,600,000 barrels per day (570,000 m3/d), in the same time frame. The Energy Information Administration (EIA) stated that gasoline usage in the United States may have peaked in 2007, in part because of increasing interest in and mandates for use of biofuels and energy efficiency.

As countries develop, industry and higher living standards drive up energy use, oil usage being a major component. Thriving economies, such as China and India, are quickly becoming large oil consumers. For example, China surpassed the United States as the world’s largest crude oil importer in 2015. Oil consumption growth is expected to continue; however, not at previous rates, as China’s economic growth is predicted to decrease from the high rates of the early part of the 21st century. India’s oil imports are expected to more than triple from 2005 levels by 2020, rising to 5 million barrels per day (790×103 m3/d).

Population

Another significant factor affecting petroleum demand has been human population growth. The United States Census Bureau predicts that world population in 2030 will be almost double that of 1980. Oil production per capita peaked in 1979 at 5.5 barrels/year but then declined to fluctuate around 4.5 barrels/year since. In this regard, the decreasing population growth rate since the 1970s has somewhat ameliorated the per capita decline.

Economic growth

Some analysts argue that the cost of oil has a profound effect on economic growth due to its pivotal role in the extraction of resources and the processing, manufacturing, and transportation of goods. As the industrial effort to extract new unconventional oil sources increases, this has a compounding negative effect on all sectors of the economy, leading to economic stagnation or even eventual contraction. Such a scenario would result in an inability for national economies to pay high oil prices, leading to declining demand and a price collapse.

Supply

Defining sources of oil

Oil may come from conventional or unconventional sources. The terms are not strictly defined, and vary within the literature as definitions based on new technologies tend to change over time. As a result, different oil forecasting studies have included different classes of liquid fuels. Some use the terms “conventional” oil for what is included in the model, and “unconventional” oil for classes excluded.

In 1956, Hubbert confined his peak oil prediction to that crude oil “producible by methods now in use.” By 1962, however, his analyses included future improvements in exploration and production. All of Hubbert’s analyses of peak oil specifically excluded oil manufactured from oil shale or mined from oil sands. A 2013 study predicting an early peak excluded deepwater oil, tight oil, oil with API gravity less than 17.5, and oil close to the poles, such as that on the North Slope of Alaska, all of which it defined as non-conventional. Some commonly used definitions for conventional and unconventional oil are detailed below.

Conventional sources

Conventional oil is extracted on land and offshore using standard techniques, and can be categorized as light, medium, heavy, or extra heavy in grade. The exact definitions of these grades vary depending on the region from which the oil came. Light oil flows naturally to the surface or can be extracted by simply pumping it out of the ground. Heavy refers to oil that has higher density and therefore lower API gravity. It does not flow easily, and its consistency is similar to that of molasses. While some of it can be produced using conventional techniques, recovery rates are better using unconventional methods.

Unconventional sources

Oil currently considered unconventional is derived from multiple sources.

Tight oil is extracted from deposits of low-permeability rock, sometimes shale deposits but often other rock types, using hydraulic fracturing, or “fracking.” It is often confused with shale oil, which is oil manufactured from the kerogen contained in an oil shale (see below), Production of tight oil has led to a resurgence of US production in recent years. U.S. tight oil production peaked in March 2015, and fell a total of 12 percent over the next 18 months. But then U.S. tight oil production rose again, and by September 2017 had exceeded the old peak, and as of October 2017, U.S. tight oil production was still rising.

Oil shale is a common term for sedimentary rock such as shale or marl, containing kerogen, a waxy oil precursor that has not yet been transformed into crude oil by the high pressures and temperatures caused by deep burial. The term “oil shale” is somewhat confusing, because what is referred to in the U.S. as “oil shale” is not really oil and the rock it is found in is generally not shale. Since it is close to the surface rather than buried deep in the earth, the shale or marl is typically mined, crushed, and retorted, producing synthetic oil from the kerogen. Its net energy yield is much lower than conventional oil, so much so that estimates of the net energy yield of shale discoveries are considered extremely unreliable.

Oil sands are unconsolidated sandstone deposits containing large amounts of very viscous crude bitumen or extra-heavy crude oil that can be recovered by surface mining or by in-situ oil wells using steam injection or other techniques. It can be liquefied by upgrading, blending with diluent, or by heating; and then processed by a conventional oil refinery. The recovery process requires advanced technology but is more efficient than that of oil shale. The reason is that, unlike U.S. “oil shale”, Canadian oil sands actually contain oil, and the sandstones they are found in are much easier to produce oil from than shale or marl. In the U.S. dialect of English, these formations are often called “tar sands”, but the material found in them is not tar but an extra-heavy and viscous form of oil technically known as bitumen. Venezuela has oil sands deposits similar in size to those of Canada, and approximately equal to the world’s reserves of conventional oil. Venezuela’s Orinoco Belt tar sands are less viscous than Canada’s Athabasca oil sands – meaning they can be produced by more conventional means – but they are buried too deep to be extracted by surface mining. Estimates of the recoverable reserves of the Orinoco Belt range from 100 billion barrels (16×109 m3) to 270 billion barrels (43×109 m3). In 2009, USGS updated this value to 513 billion barrels (8.16×1010 m3).

Coal liquefaction or gas to liquids product are liquid hydrocarbons that are synthesised from the conversion of coal or natural gas by the Fischer-Tropsch process, Bergius process, or Karrick process. Currently, two companies SASOL and Shell, have synthetic oil technology proven to work on a commercial scale. Sasol’s primary business is based on CTL (coal-to-liquid) and GTL (natural gas-to-liquid) technology, producing US$4.40 billion in revenues (FY2009). Shell has used these processes to recycle waste flare gas (usually burnt off at oil wells and refineries) into usable synthetic oil. However, for CTL there may be insufficient coal reserves to supply global needs for both liquid fuels and electric power generation.

Minor sources include thermal depolymerization, as discussed in a 2003 article in Discover magazine, that could be used to manufacture oil indefinitely, out of garbage, sewage, and agricultural waste. The article claimed that the cost of the process was $15 per barrel. A follow-up article in 2006 stated that the cost was actually $80 per barrel, because the feedstock that had previously been considered as hazardous waste now had market value. A 2008 news bulletin published by Los Alamos Laboratory proposed that hydrogen (possibly produced using hot fluid from nuclear reactors to split water into hydrogen and oxygen) in combination with sequestered CO2 could be used to produce methanol (CH3OH), which could then be converted into gasoline.

Discoveries

The peak of world oilfield discoveries occurred in the 1960s at around 55 billion barrels (8.7×109 m3)(Gb)/year. According to the Association for the Study of Peak Oil and Gas (ASPO), the rate of discovery has been falling steadily since. Less than 10 Gb/yr of oil were discovered each year between 2002 and 2007. According to a 2010 Reuters article, the annual rate of discovery of new fields has remained remarkably constant at 15–20 Gb/yr.

But despite the fall-off in new field discoveries, and record-high production rates, the reported proved reserves of crude oil remaining in the ground in 2014, which totaled 1,490 billion barrels, not counting Canadian heavy oil sands, were more than quadruple the 1965 proved reserves of 354 billion barrels. A researcher for the U.S. Energy Information Administration has pointed out that after the first wave of discoveries in an area, most oil and natural gas reserve growth comes not from discoveries of new fields, but from extensions and additional gas found within existing fields.

A report by the UK Energy Research Centre noted that “discovery” is often used ambiguously, and explained the seeming contradiction between falling discovery rates since the 1960s and increasing reserves by the phenomenon of reserve growth. The report noted that increased reserves within a field may be discovered or developed by new technology years or decades after the original discovery. But because of the practice of “backdating,” any new reserves within a field, even those to be discovered decades after the field discovery, are attributed to the year of initial field discovery, creating an illusion that discovery is not keeping pace with production.

Reserves

Total possible conventional crude oil reserves include crude oil with 90% certainty of being technically able to be produced from reservoirs (through a wellbore using primary, secondary, improved, enhanced, or tertiary methods); all crude with a 50% probability of being produced in the future (probable); and discovered reserves that have a 10% possibility of being produced in the future (possible). Reserve estimates based on these are referred to as 1P, proven (at least 90% probability); 2P, proven and probable (at least 50% probability); and 3P, proven, probable and possible (at least 10% probability), respectively. This does not include liquids extracted from mined solids or gasses (oil sands, oil shale, gas-to-liquid processes, or coal-to-liquid processes).

Hubbert’s 1956 peak projection for the United States depended on geological estimates of ultimate recoverable oil resources, but starting in his 1962 publication, he concluded that ultimate oil recovery was an output of his mathematical analysis, rather than an assumption. He regarded his peak oil calculation as independent of reserve estimates.

Many current 2P calculations predict reserves to be between 1150 and 1350 Gb, but some authors have written that because of misinformation, withheld information, and misleading reserve calculations, 2P reserves are likely nearer to 850–900 Gb. The Energy Watch Group wrote that actual reserves peaked in 1980, when production first surpassed new discoveries, that apparent increases in reserves since then are illusory, and concluded (in 2007): “Probably the world oil production has peaked already, but we cannot be sure yet.”

Concerns over stated reserves

One difficulty in forecasting the date of peak oil is the opacity surrounding the oil reserves classified as “proven”. In many major producing countries, the majority of reserves claims have not been subject to outside audit or examination. Many worrying signs concerning the depletion of proven reserves have emerged in recent years. This was best exemplified by the 2004 scandal surrounding the “evaporation” of 20% of Shell’s reserves.

For the most part, proven reserves are stated by the oil companies, the producer states and the consumer states. All three have reasons to overstate their proven reserves: oil companies may look to increase their potential worth; producer countries gain a stronger international stature; and governments of consumer countries may seek a means to foster sentiments of security and stability within their economies and among consumers.

Major discrepancies arise from accuracy issues with the self-reported numbers from the Organization of the Petroleum Exporting Countries (OPEC). Besides the possibility that these nations have overstated their reserves for political reasons (during periods of no substantial discoveries), over 70 nations also follow a practice of not reducing their reserves to account for yearly production. Analysts have suggested that OPEC member nations have economic incentives to exaggerate their reserves, as the OPEC quota system allows greater output for countries with greater reserves.

Kuwait, for example, was reported in the January 2006 issue of Petroleum Intelligence Weekly to have only 48 billion barrels (7.6×109 m3) in reserve, of which only 24 were fully proven. This report was based on the leak of a confidential document from Kuwait and has not been formally denied by the Kuwaiti authorities. This leaked document is from 2001, but excludes revisions or discoveries made since then. Additionally, the reported 1.5 billion barrels (240×106 m3) of oil burned off by Iraqi soldiers in the First Persian Gulf War are conspicuously missing from Kuwait’s figures.

On the other hand, investigative journalist Greg Palast argues that oil companies have an interest in making oil look more rare than it is, to justify higher prices. This view is contested by ecological journalist Richard Heinberg. Other analysts argue that oil producing countries understate the extent of their reserves to drive up the price.

Reserves of unconventional oil

As conventional oil becomes less available, it can be replaced with production of liquids from unconventional sources such as tight oil, oil sands, ultra-heavy oils, gas-to-liquid technologies, coal-to-liquid technologies, biofuel technologies, and shale oil. In the 2007 and subsequent International Energy Outlook editions, the word “Oil” was replaced with “Liquids” in the chart of world energy consumption. In 2009 biofuels was included in “Liquids” instead of in “Renewables”. The inclusion of natural gas liquids, a bi-product of natural gas extraction, in “Liquids” has been criticized as it is mostly a chemical feedstock which is generally not used as transport fuel.

Reserve estimates are based on the oil price. Hence, unconventional sources such as heavy crude oil, oil sands, and oil shale may be included as new techniques reduce the cost of extraction. With rule changes by the SEC, oil companies can now book them as proven reserves after opening a strip mine or thermal facility for extraction. These unconventional sources are more labor and resource intensive to produce, however, requiring extra energy to refine, resulting in higher production costs and up to three times more greenhouse gas emissions per barrel (or barrel equivalent) on a “well to tank” basis or 10 to 45% more on a “well to wheels” basis, which includes the carbon emitted from combustion of the final product.

While the energy used, resources needed, and environmental effects of extracting unconventional sources have traditionally been prohibitively high, major unconventional oil sources being considered for large-scale production are the extra heavy oil in the Orinoco Belt of Venezuela, the Athabasca Oil Sands in the Western Canadian Sedimentary Basin, and the oil shale of the Green River Formation in Colorado, Utah, and Wyoming in the United States. Energy companies such as Syncrude and Suncor have been extracting bitumen for decades but production has increased greatly in recent years with the development of Steam Assisted Gravity Drainage and other extraction technologies.

Chuck Masters of the USGS estimates that, “Taken together, these resource occurrences, in the Western Hemisphere, are approximately equal to the Identified Reserves of conventional crude oil accredited to the Middle East.” Authorities familiar with the resources believe that the world’s ultimate reserves of unconventional oil are several times as large as those of conventional oil and will be highly profitable for companies as a result of higher prices in the 21st century. In October 2009, the USGS updated the Orinoco tar sands (Venezuela) recoverable “mean value” to 513 billion barrels (8.16×1010 m3), with a 90% chance of being within the range of 380-652 billion barrels (103.7×109 m3), making this area “one of the world’s largest recoverable oil accumulations”.

Despite the large quantities of oil available in non-conventional sources, Matthew Simmons argued in 2005 that limitations on production prevent them from becoming an effective substitute for conventional crude oil. Simmons stated “these are high energy intensity projects that can never reach high volumes” to offset significant losses from other sources. Another study claims that even under highly optimistic assumptions, “Canada’s oil sands will not prevent peak oil,” although production could reach 5,000,000 bbl/d (790,000 m3/d) by 2030 in a “crash program” development effort.

Moreover, oil extracted from these sources typically contains contaminants such as sulfur and heavy metals that are energy-intensive to extract and can leave tailings, ponds containing hydrocarbon sludge, in some cases. The same applies to much of the Middle East’s undeveloped conventional oil reserves, much of which is heavy, viscous, and contaminated with sulfur and metals to the point of being unusable. However, high oil prices make these sources more financially appealing. A study by Wood Mackenzie suggests that by the early 2020s all the world’s extra oil supply is likely to come from unconventional sources.

Production

The point in time when peak global oil production occurs defines peak oil. Some adherents of ‘peak oil’ believe that production capacity will remain the main limitation of supply, and that when production decreases, it will be the main bottleneck to the petroleum supply/demand equation. Others believe that the increasing industrial effort to extract oil will have a negative effect on global economic growth, leading to demand contraction and a price collapse, thereby causing production decline as some unconventional sources become uneconomical. Yet others believe that the peak may be to some extent led by declining demand as new technologies and improving efficiency shift energy usage away from oil.

Worldwide oil discoveries have been less than annual production since 1980. World population has grown faster than oil production. Because of this, oil production per capita peaked in 1979 (preceded by a plateau during the period of 1973–1979).

The increasing investment in harder-to-reach oil as of 2005 was said to signal oil companies’ belief in the end of easy oil. While it is widely believed that increased oil prices spur an increase in production, an increasing number of oil industry insiders were reportedly coming to believe in 2009 that even with higher prices, oil production was unlikely to increase significantly. Among the reasons cited were both geological factors as well as “above ground” factors that are likely to see oil production plateau.

The assumption of inevitable declining volumes of oil and gas produced per unit of effort is contrary to recent experience in the US. In the United States, as of 2017, there has been an ongoing decade-long increase in the productivity of oil and gas drilling in all the major tight oil and gas plays. The US Energy Information Administration reports, for instance, that in the Bakken Shale production area of North Dakota, the volume of oil produced per day of drilling rig time in January 2017 was 4 times the oil volume per day of drilling five years previous, in January 2012, and nearly 10 times the oil volume per day of ten years previous, in January 2007. In the Marcellus gas region of the northeast, The volume of gas produced per day of drilling time in January 2017 was 3 times the gas volume per day of drilling five years previous, in January 2012, and 28 times the gas volume per day of drilling ten years previous, in January 2007.

Anticipated production by major agencies

Average yearly gains in global supply from 1987 to 2005 were 1.2 million barrels per day (190×103 m3/d) (1.7%). In 2005, the IEA predicted that 2030 production rates would reach 120,000,000 barrels per day (19,000,000 m3/d), but this number was gradually reduced to 105,000,000 barrels per day (16,700,000 m3/d). A 2008 analysis of IEA predictions questioned several underlying assumptions and claimed that a 2030 production level of 75,000,000 barrels per day (11,900,000 m3/d) (comprising 55,000,000 barrels (8,700,000 m3) of crude oil and 20,000,000 barrels (3,200,000 m3) of both non-conventional oil and natural gas liquids) was more realistic than the IEA numbers. More recently, the EIA’s Annual Energy Outlook 2015 indicated no production peak out to 2040. However, this required a future Brent crude oil price of $US144/bbl (2013 dollars) “as growing demand leads to the development of more costly resources”. Whether the world economy can grow and maintain demand for such a high oil price remains to be seen.

Oil field decline

In a 2013 study of 733 giant oil fields, only 32% of the ultimately recoverable oil, condensate and gas remained. Ghawar, which is the largest oil field in the world and responsible for approximately half of Saudi Arabia’s oil production over the last 50 years, was in decline before 2009. The world’s second largest oil field, the Burgan Field in Kuwait, entered decline in November 2005.

Mexico announced that production from its giant Cantarell Field began to decline in March 2006, reportedly at a rate of 13% per year. Also in 2006, Saudi Aramco Senior Vice President Abdullah Saif estimated that its existing fields were declining at a rate of 5% to 12% per year. According to a study of the largest 811 oilfields conducted in early 2008 by Cambridge Energy Research Associates, the average rate of field decline is 4.5% per year. The Association for the Study of Peak Oil and Gas agreed with their decline rates, but considered the rate of new fields coming online overly optimistic. The IEA stated in November 2008 that an analysis of 800 oilfields showed the decline in oil production to be 6.7% a year for fields past their peak, and that this would grow to 8.6% in 2030. A more rapid annual rate of decline of 5.1% in 800 of the world’s largest oil fields weighted for production over their whole lives was reported by the International Energy Agency in their World Energy Outlook 2008. The 2013 study of 733 giant fields mentioned previously had an average decline rate 3.83% which was described as “conservative.”

Control over supply

Entities such as governments or cartels can reduce supply to the world market by limiting access to the supply through nationalizing oil, cutting back on production, limiting drilling rights, imposing taxes, etc. International sanctions, corruption, and military conflicts can also reduce supply.

Nationalization of oil supplies

Another factor affecting global oil supply is the nationalization of oil reserves by producing nations. The nationalization of oil occurs as countries begin to deprivatize oil production and withhold exports. Kate Dourian, Platts’ Middle East editor, points out that while estimates of oil reserves may vary, politics have now entered the equation of oil supply. “Some countries are becoming off limits. Major oil companies operating in Venezuela find themselves in a difficult position because of the growing nationalization of that resource. These countries are now reluctant to share their reserves.”

OPEC influence on supply

OPEC is an alliance among 14 diverse oil-producing countries (as of May 2017: Algeria, Angola, Ecuador, Equatorial Guinea, Gabon, Iran, Iraq, Kuwait, Libya, Nigeria, Qatar, Saudi Arabia, United Arab Emirates, Venezuela) to manage the supply of oil. OPEC’s power was consolidated in the 1960s and 1970s as various countries nationalized their oil holdings, and wrested decision-making away from the “Seven Sisters” (Anglo-Iranian, Socony, Royal Dutch Shell, Gulf, Esso, Texaco, Socal), and created their own oil companies to control the oil. OPEC often tries to influence prices by restricting production. It does this by allocating each member country a quota for production. Members agree to keep prices high by producing at lower levels than they otherwise would. There is no way to enforce adherence to the quota, so each member has an individual incentive to “cheat” the cartel.

Commodities trader Raymond Learsy, author of Over a Barrel: Breaking the Middle East Oil Cartel, contends that OPEC has trained consumers to believe that oil is a much more finite resource than it is. To back his argument, he points to past false alarms and apparent collaboration. He also believes that peak oil analysts have conspired with OPEC and the oil companies to create a “fabricated drama of peak oil” to drive up oil prices and profits; oil had risen to a little over $30/barrel at that time. A counter-argument was given in the Huffington Post after he and Steve Andrews, co-founder of ASPO, debated on CNBC in June 2007.

Source from Wikipedia